In the Value Creation Era, Maestro Has Emerged as the Essential Technology Driving Growth in PE

When Maestro was first conceived, the idea of formalized value creation and the need for a dedicated platform to support it was hardly on the radar of most private equity firms. At the time, the industry was still predominantly entrenched in an era of relying on financial engineering and buy-and-hold strategies for achieving successful exits.

As market conditions changed and competition for deals began to intensify, forward-thinking sponsors saw an opportunity to drive better outcomes by taking a proactive role in creating value across the portfolio, leading to an initial maturation and evolution of the industry which involved technology adoption. But even those initial value creation efforts were typically very manual and disconnected in nature, featuring Excel spreadsheets, PowerPoint presentations, and email-based communication. It was around this time that the first generation of Maestro launched and offered PE sponsors, as well as portfolio companies and partners, a new yet nascent technology-enabled solution for accelerating growth through value creation.

In the Beginning…

Maestro came on the scene as a software solution with features and capabilities to support tactical value creation planning and execution. The earliest iteration of the platform offered tools to help orchestrate value creation plans and enable users to create playbooks and capture successful initiatives that could be replicated as new companies joined the portfolio. Maestro also introduced a more efficient way of collaborating across all stakeholder groups.

In short order, Maestro secured PE firm users, mainly smaller and emerging funds more readily able and willing to embrace technology. Maestro helped these early users solve certain problems and start to operationalize value creation. Feedback from users helped guide and inform the development of new features and capabilities.

An Industry-Wide Commitment to Value Creation Emerges

As Maestro was building traction and establishing its brand, the next shift in PE took hold. Larger sponsors began to see structured value creation planning as a critical requirement for growth. The proliferation of firms and increased competition for deals meant that financial engineering and multiple expansions were no longer sufficient for meeting goals and expectations. Investors took a greater interest in understanding a firm’s unique and differentiated approach to value creation as they analyzed how best to deploy their funds. Driving operational excellence across the portfolio quickly became a top priority.

Additionally, with the turn towards value creation driving greater involvement from an expanding universe of operating partners, deal team members, external consultants, and multiple organizations working together to drive outcomes, the need emerged for ongoing collaboration that only a modernized and sophisticated technology platform could support.

Maestro Cements Its Standing and Ascends the Value Chain

As the only purpose-built platform for value creation in PE, Maestro was perfectly positioned to capitalize as the shift accelerated across the industry. Larger, established firms with tens of billions of dollars in assets under management began deploying the platform to drive change across their organizations and institute a modernized and digitized approach to value creation.

The software platform created before PE knew it needed it had become a critical component of the technology stack and the vehicle driving value creation forward.

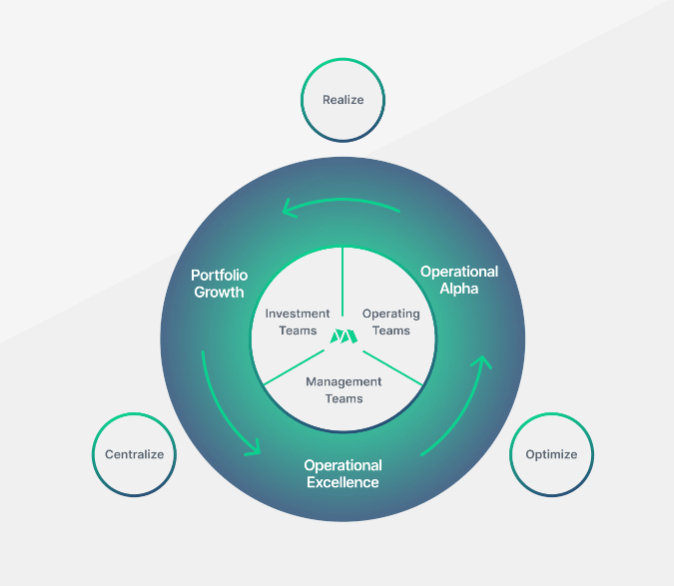

Maestro is no longer characterized by software features, tools, or memorialized playbooks. Today, Maestro drives outcomes for a wide range of PE firms – from emerging managers to midmarket and mega funds – and their ecosystem of stakeholders, supporting the full lifecycle of PE activity from 100-day planning to exit and everything in between. Deal teams, operating partners, portfolio company management, and service providers rely on Maestro as they work together to achieve operational alpha and drive portfolio growth.

Accolades, Accomplishments, and Growth

Industry watchers and media organizations have taken notice of Maestro’s ascent. Last week, Maestro was awarded the Startup Solution of the Year by Private Equity Wire. In March, Maestro won the Value Creation Software Solution Award from Actum Group.

More than 50 PE firms and over 1,000 PE-backed companies use Maestro today to plan, execute, measure, and report on the impact of value creation initiatives.

In addition to processes and technology, the Maestro team has expanded to include a deep bench of subject matter experts and functional specialists available to support unique user requirements. With thousands of value creation initiatives being managed on the platform, the Maestro team continues to accumulate rich knowledge used to help sponsors and portfolio companies solve challenges and accelerate growth through operationalized, technology-enabled value creation strategies.

If you haven’t yet explored how Maestro can help your firm enhance value creation outcomes, click here to schedule a demo!