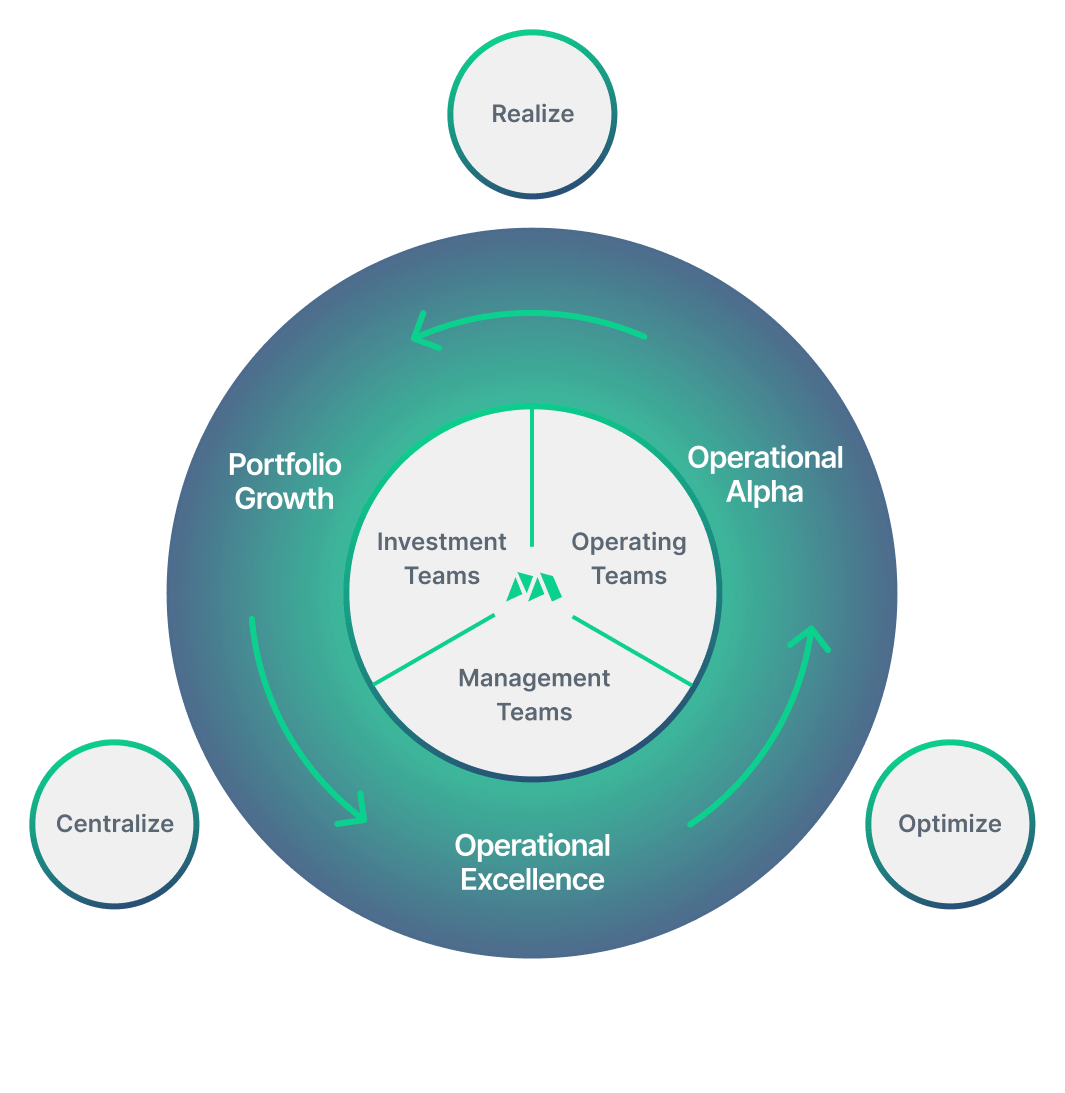

Operational excellence at our core

Combining modern technology and market-leading services, PE firms and their Portfolio Companies that count operational excellence among their top priorities choose Maestro.

We know value creation

As Value Creation becomes pervasive in PE, generic tools and web-based project management platforms are unable to underpin the market’s technology needs. Built from the ground up for Value Creation and Strategy Execution, Maestro channels years of market expertise into operational best practices to address today’s requirements for portfolio operations excellence in one platform.

Modern technology

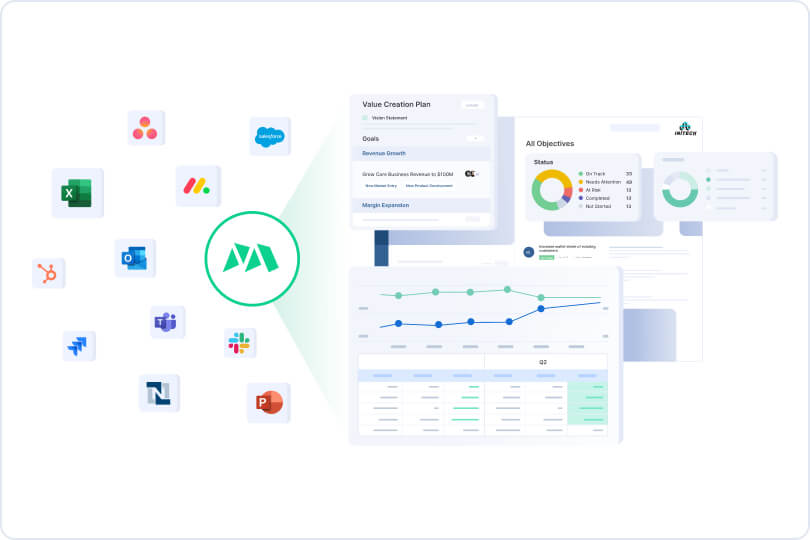

The Maestro platform builds on PE best practices while staying ahead of the latest innovations and integrations. Maestro works in continuous delivery with our software designed solely for PE and portfolio company users. This means that best-in-class integrations across the PE technology stack are built-in, and product updates are frequent, timely and always purpose-built for value creation.

Tailored implementation

& onboarding

With experience setting up VCPs for over 1000+ sponsor-backed companies from top PE firms, Maestro provides in-depth guidance, proven templates, and examples of market best practices for planning, executing, and reporting on value creation for individual clients, and across stakeholders.

Expert support & services

The Maestro team has helped the world’s leading PE firms digitize, centralize, and realize their value creation strategies for success. All clients are paired with a dedicated Client Success Manager (“CSM”), that brings proven experience with a laser focus on best practice PE processes and strategic frameworks to all training, professional services, and support.

Working with Maestro

Say goodbye to dispersed data, siloed teams, and itemized initiatives. Maestro delivers a professionalized and structured approach to operational value creation at your fund within weeks.

The Maestro implementation and onboarding process is collaborative and best-practice-led, purposefully tailored for each client and all stakeholder groups.

The team takes each client through key stages of PE value creation and strategy execution success; set-up and define your plan, orchestrate execution, and measure impact, all powered by a centralized, real-time view of your financial and operational metrics.

“Within Weeks of Launch, the Argonaut operations team had Maestro up and running, using it to craft detailed value creation journeys and to track KPIs tied to investment objectives.”

Maestro service highlights

With Maestro, you receive expert guidance on VCP planning, execution, measurement and reporting, as well as proven playbooks, templates and accelerators for rapid deployment and platform adoption, including:

- VCP best practices and guidance with examples from industry leading firms.

- KPI templates and workflow examples, by industry.

- Tailored GP and Portfolio Company value alignment sessions.Tailored GP and Portfolio Company value alignment sessions.

Services | Proven Maestro accelerators

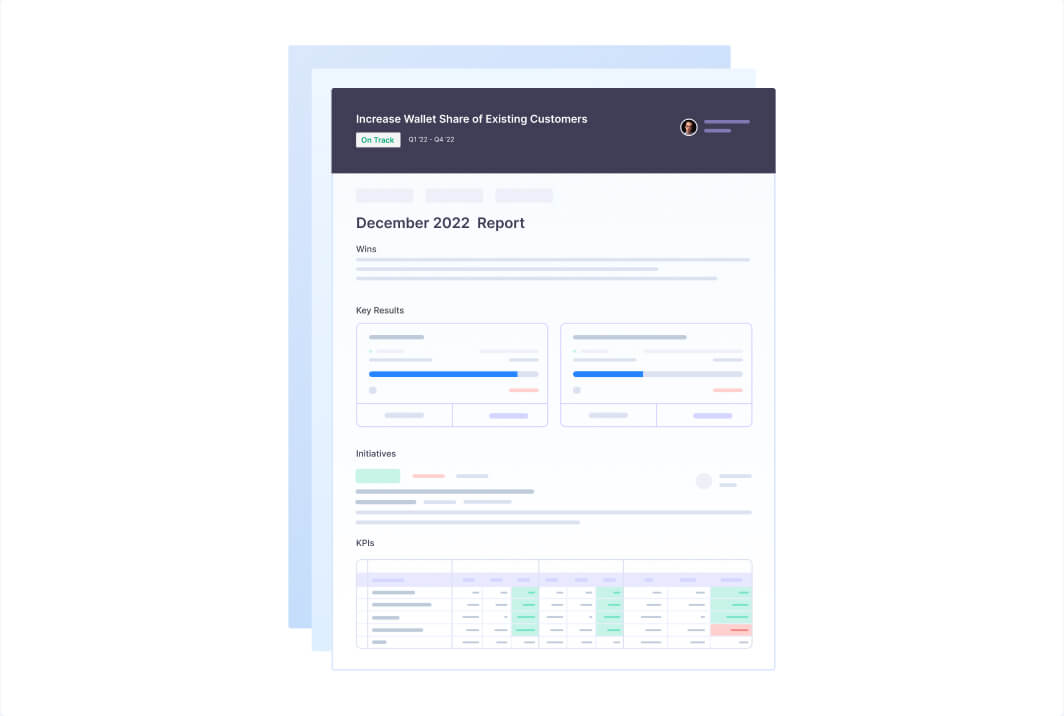

Defining value creation plan

Templatized VCPs with industry examples, strategic frameworks and best practices.

Orchestrating execution

Board and ExCo reporting templates, and governance models.

Measuring value created

Standard KPI templates and workflow examples by industry, and integrations with ERP, KPI and other data sources.

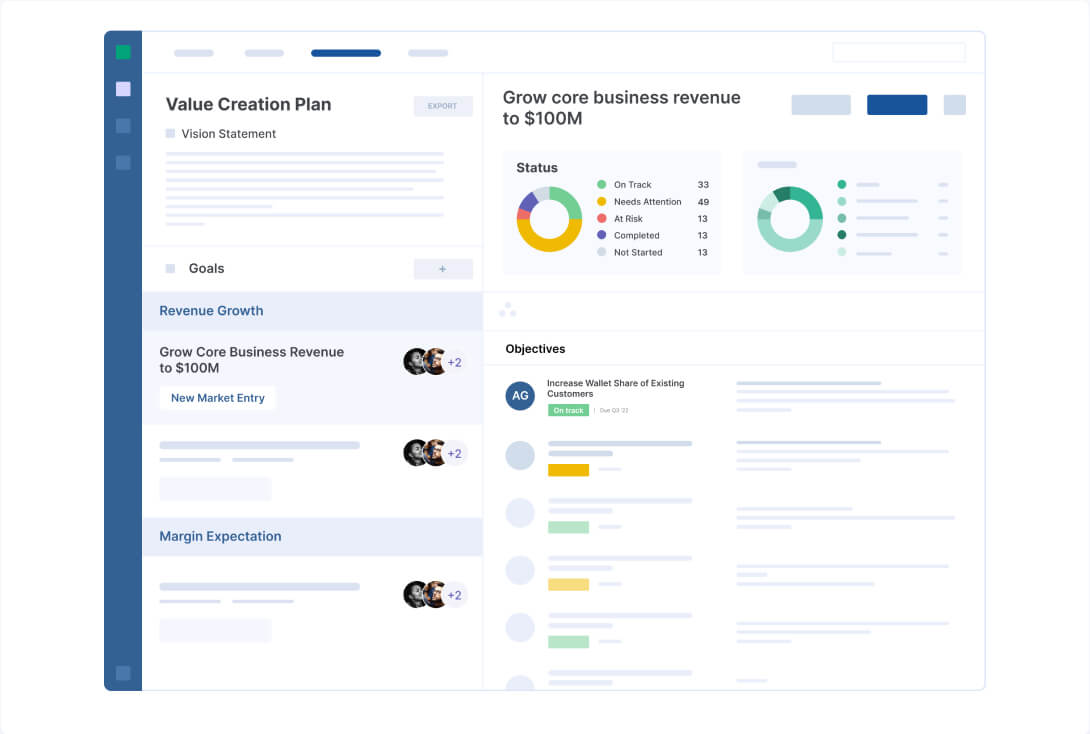

Your value creation strategy, best practice frameworks and processes. One streamlined, centralized workspace.

Aggregate

All data assets in one location

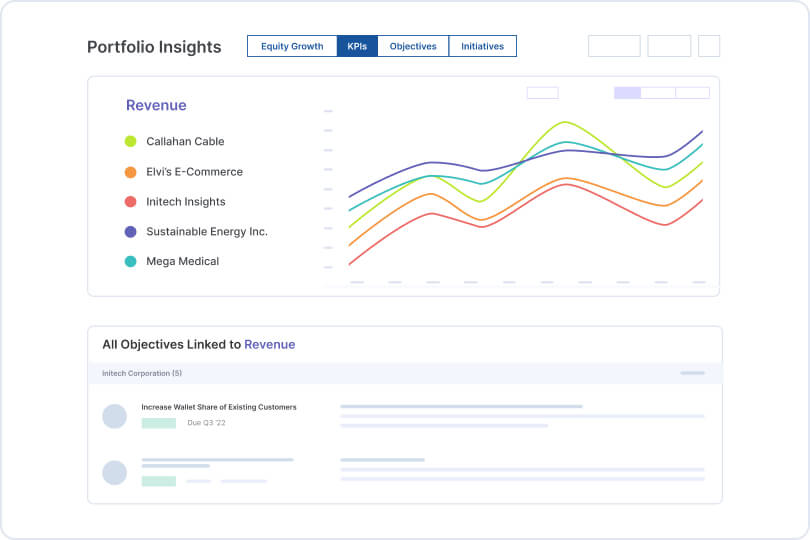

Centralize disparate datasets for a single view of real-time financial and operational metrics to identify the true drivers of equity value. Maestro ingests, aggregates, and organizes all data assets for deeper insights and reporting on value creation process and impact.

Integrate

Your preferred workplace tools

Integrate collaboration and communications tools into one easily accessible, centralized platform. From NetSuite to Salesforce to Snowflake and more. Maestro integrates with all the ERP, CRM and Data Warehouse platforms used by private equity firms and portfolio companies.

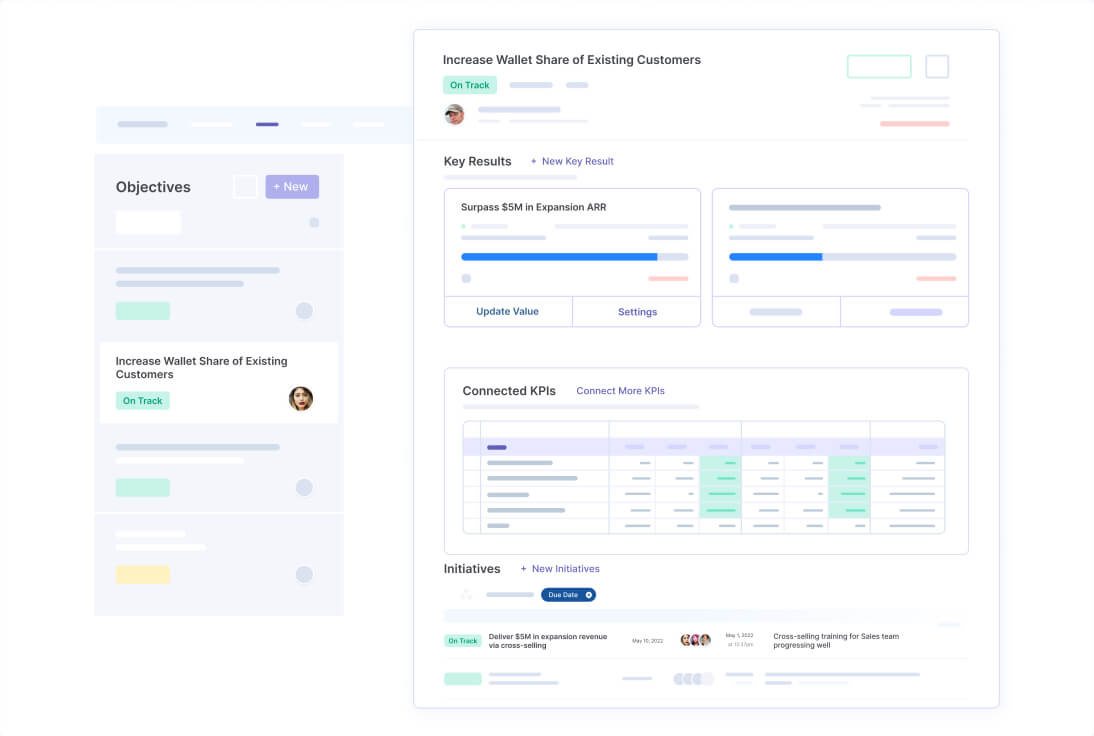

Centralize & manage

Value creation objectives and KPIs in one place

Establish, align, and monitor plan priorities with a centralized system to coordinate, track and report on strategic initiatives across the portfolio. With configurable dashboards and seamless embedded BI integrations, Maestro powers strategy execution with unmatched visibility and analytics into the progress and impact of critical priorities & metrics.

Further reading

A deeper dive into Maestro Integrations

Crafting a winning 100 day plan

Bridging the gap between strategy and execution in PE integrations

Schedule a product demo

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to Find Us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

111 Huntington St, 6th Floor,Boston, MA 02199