The value creation platform for PE

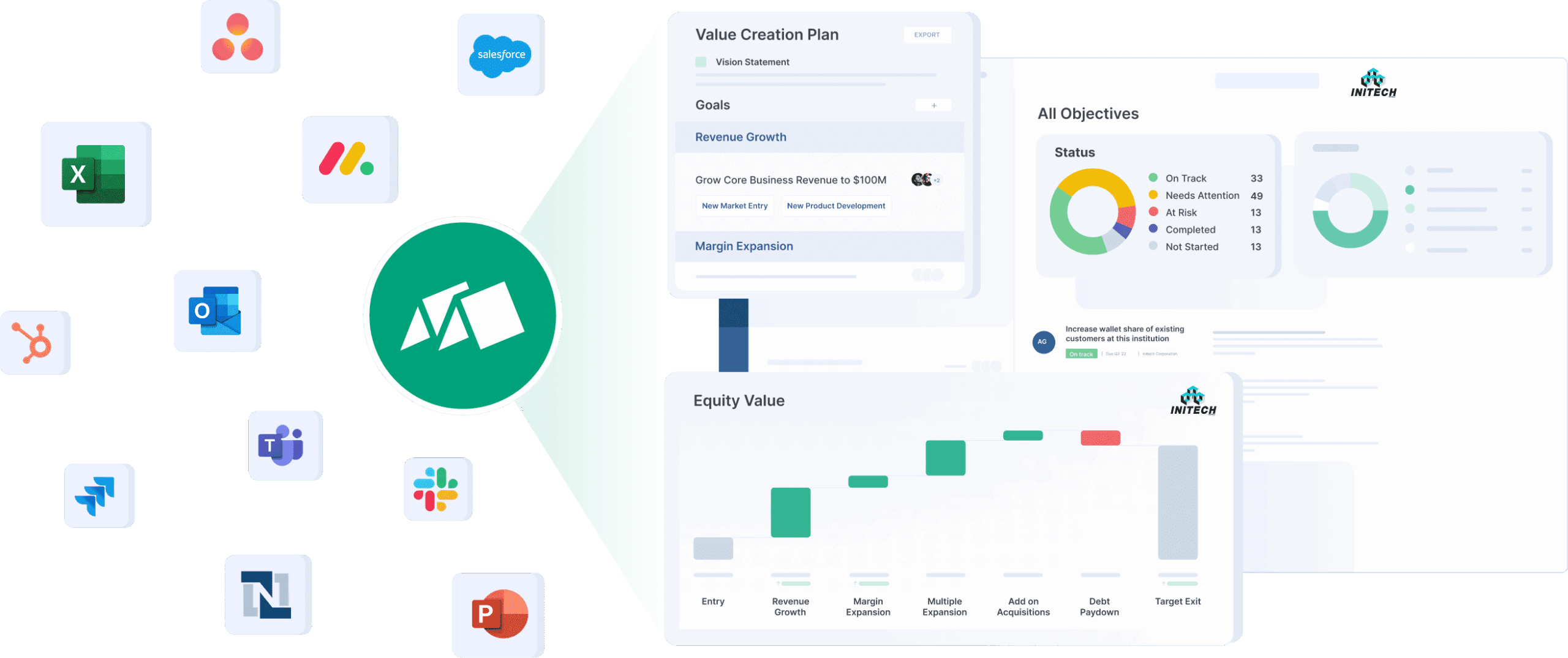

Maestro clients demonstrate 4x fundraising advantage and consistently outperform peers. The platform for PE firms and portfolio companies serious about delivering operational alpha…

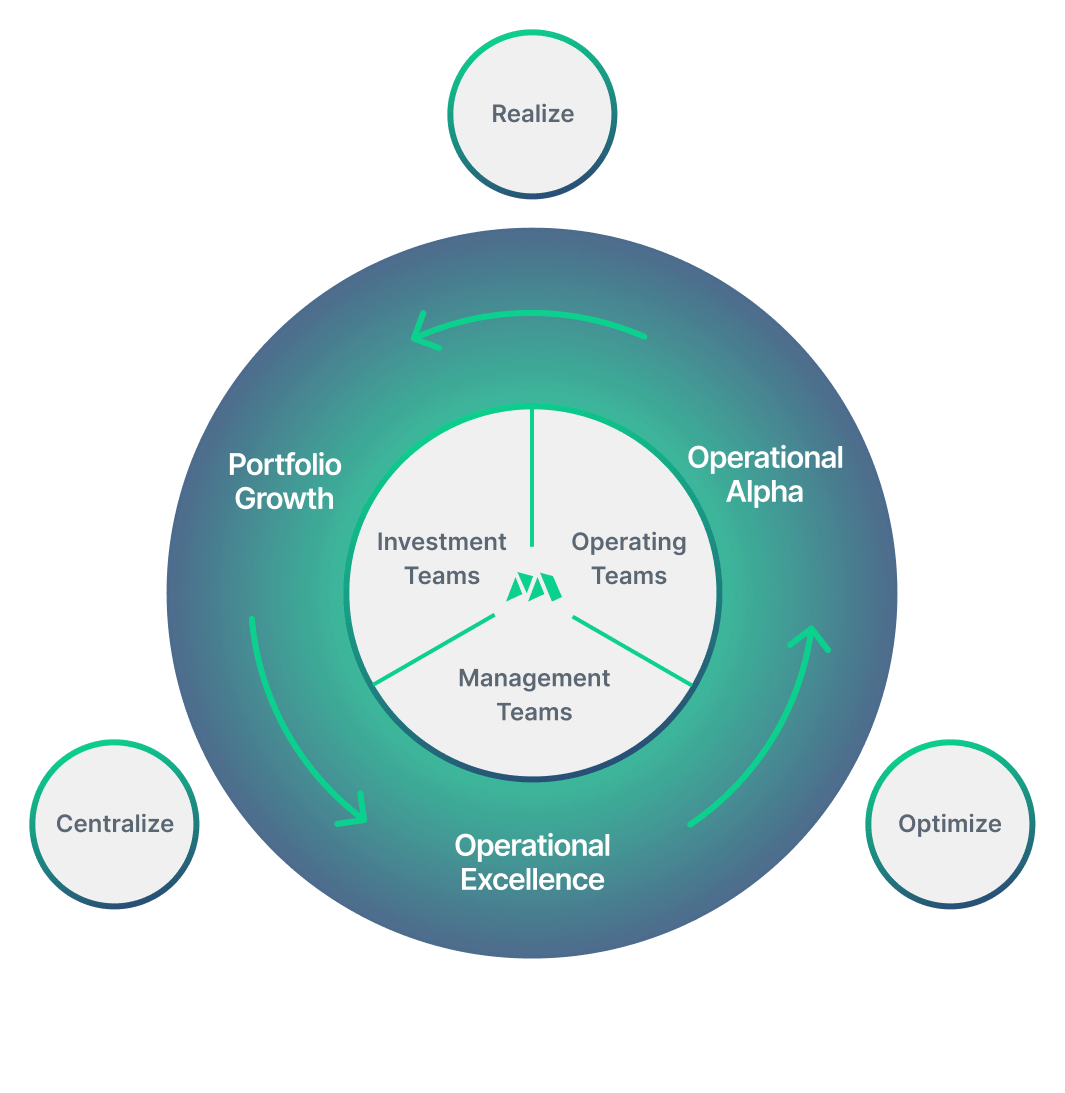

Drive operational alpha

Align on strategy, deploy strategic initiatives, monitor the financial and operational impact, and generate compelling, data-driven reports that quantify operating alpha. Maestro is the only platform designed to plan, execute, measure and report on value creation across the portfolio.

“We use Maestro to maximize the ROI of our Portfolio Resources Group and track execution of every value creation initiative we pursue”

The Maestro advantage

Align teams

Ensure alignment on the investment thesis and value creation plan from day one for deal teams, operating partners, and portfolio companies.

Deploy strategy

Deliver value with confidence and efficiency, using frameworks and workflows built specifically for transformative value creation.

Measure impact

Enhance decision-making and drive transparency by connecting real-time financial and operational metrics to value creation initiatives.

Report on results

Automate reporting and generate streamlined, templated outputs for portfolio reviews, board meetings, and investor updates.

The modern approach to value creation

Maestro is for…

PE Operating Partners

Plan, execute, measure, and report on value creation initiatives — from the first 100 days to a successful exit.

For PE-backed Leadership Teams

Drive alignment and clarity on your strategic priorities and automate management and reporting requirements.

Powering more than

Private equity sponsors

Portfolio companies

Value creation initiatives

Hear from our clients

Maestro takes us beyond tracking projects to focusing on strategy and outcomes. As more data flows into the platform, so does insight—and that’s where real value creation happens.

Ben WillisOperating Principal, Bregal

We have a highly transformative agenda at our Portfolio Companies and Maestro has become the transformation source of truth across all levels of the organization, right up to board and deal teams.

Edward HennahVP Portfolio Operations, Motive Partners

Argonaut approaches each of its investments as a partnership, and immediately recognized Maestro’s strengths in helping its portfolio partners grow their companies’ top and bottom lines.

Brian GreenVice President, Argonaut Private Equity

We use Maestro to maximize the RoI of our portfolio Resources Group and track execution of every value creation initiative we pursue.

For me, meetings are starting to be very easy and very productive. I just open Maestro, share my screen, and company leaders and stakeholders can have access as we navigate. I don’t need to reproduce other stuff which is very helpful.

Maestro is the primary tool that powers our integrated approach to value creation. Maestro allows me to have full visibility into plan objectives and helps me work in conjunction with other leaders at our company without siloes.

Melissa SopwithHead of Marketing, PFB Custom Homes GroupsIndustry recognition

Private Equity Wire US Awards 2024

Winner. Start-Up Solution of the Year.

Actum Group Private Equity Value Creation Forum & Awards 2025

Winner. Value Creation Software Solution Award

Real Deals ESG Awards 2024

Finalist. Technology Provider of the Year.

Schedule a product demo

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to find us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

111 Huntington St, 6th Floor,Boston, MA 02199

Eager to learn more?

Download our brochure to learn more about how you can accelerate value creation at your firm

![How Growth Factors Unlocked Portfolio Visibility Across Bregal Sagemount with Maestro and iLEVEL [Client Story]](https://www.go-maestro.com/wp-content/uploads/2024/10/1679828301042.jpeg)