Value creation success, powered by Maestro.

The world’s leading PE firms rely on Maestro to plan, execute, report, and measure the impact of value creation.

From PEI 100 to new funds

Purpose-built and fully configurable to meet the unique requirements of sponsors and their portfolio companies as they seek operational alpha, Maestro clients span the entire Private Equity landscape from PEI 100 firms to the world’s fastest growing emerging managers.

Powering more than

in AUM

of the PEI Top 300

Portfolio Companies

Hear from our clients

Argonaut approaches each of its investments as a partnership with the seller, and immediately recognized Maestro’s strengths in helping its portfolio partners grow their companies’ top and bottom lines. Within weeks of launch, the Argonaut operations team had Maestro up and running, using it to craft detailed value creation journeys and to track KPIs tied to investment objectives.

Brian GreenVice President, Argonaut Private Equity

Maestro is the primary tool that powers our integrated approach to value creation. Maestro allows me to have full visibility into plan objectives and helps me work in conjunction with other leaders at our company without siloes.

Melissa SopwithHead of Marketing, PFB Custom Homes Groups

For me, meetings are starting to be very easy and very productive. I just open Maestro, share my screen, and company leaders and stakeholders can have access as we navigate. I don’t need to reproduce other stuff which is very helpful.

Fernanda RavazzoloChief Strategy Officer, INW

We have a highly transformative agenda at our Portfolio Companies and Maestro has become the transformation source of truth across all levels of the organization, right up to board and deal teams.

Edward HennahVP Portfolio Operations, Motive PartnersDiscover how Maestro’s configurable platform and best-practice expertise ensure value creation success for firms of all sizes and at every stage of maturity.

Featured use cases and client stories

PE Client Stories

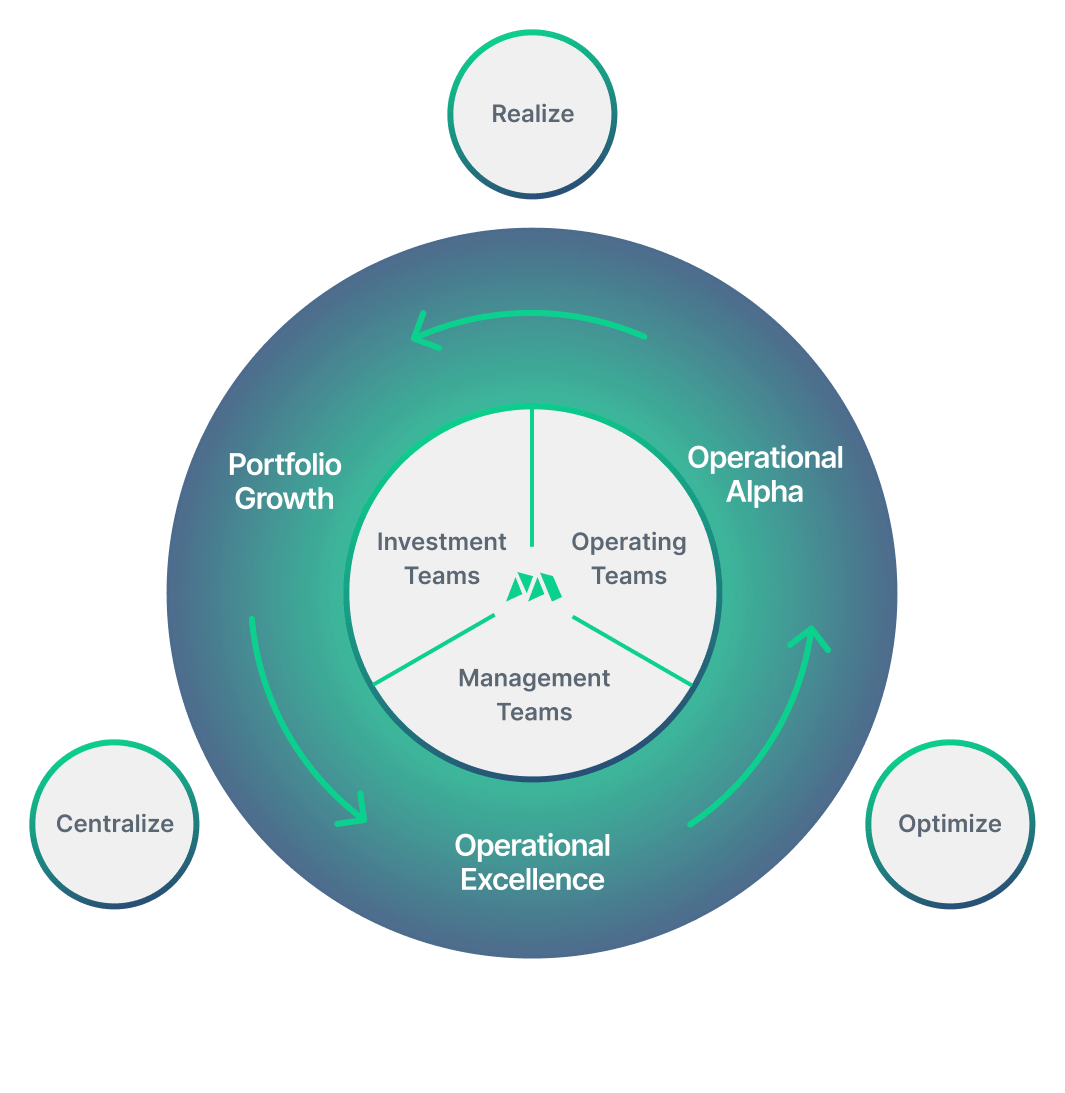

How Maestro Created an Operating Model for Investors and Operating Teams to Manage Portfolio Value Creation.

Portfolio Company Case Study

How Three PE-Backed Companies Use Maestro to Track, Progress, Establish Accountability & Achieve Results.

PE Sponsor Case Study

How one mid-size European Sponsor Implemented a more Formalized Approach to Assessing, Monitoring, and Gauging ESG Performance with Maestro.

Motive Partners Case Study

Motive Partners Turns to Maestro for Structured, Data-Powered Value Creation Framework.

“Maestro has become the transformation source of truth across all levels of the organization, right up to board and deal teams.”

Schedule a product demo

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to Find Us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

111 Huntington St, 6th Floor,Boston, MA 02199